Commercial Real Estate Industry Trends: Insights and Future Outlook

The commercial real estate industry is a dynamic landscape that constantly evolves in response to changing market conditions, technological advancements, and societal shifts. As we progress through 2023, it is imperative for stakeholders to understand the prevailing trends that are reshaping the sector. This article delves into the significant trends influencing commercial real estate, providing valuable insights for investors, developers, and real estate professionals.

Understanding the Current Landscape of Commercial Real Estate

The aftermath of the pandemic has led to profound changes in the commercial real estate sector. With remote work becoming a mainstream option and the demand for flexible spaces on the rise, investors and developers must adapt their strategies. The changing needs of tenants, coupled with shifts in consumer behavior, directly affect property values and investment decisions.

1. Growth of E-Commerce and Its Impact on Retail Spaces

The surge in e-commerce has significantly influenced retail real estate. Traditional brick-and-mortar stores are now re-evaluating their space requirements, leading to a notable decline in demand for large retail spaces. Consequently, the trend is shifting towards mixed-use developments that combine residential, retail, and commercial elements. This integrative approach not only enhances consumer experience but also maximizes property utility and revenue potential.

2. The Rise of Flexible Workspaces

The concept of flexible workspaces has gained immense popularity since the onset of the pandemic. Many businesses are adopting hybrid work models that require less traditional office space. As a result, coworking spaces and shared offices are proliferating. Developers are responding by reimagining existing office buildings to accommodate these needs, transforming static environments into collaborative and adaptive workspaces. This transformation is pivotal in attracting tenants who prioritize flexibility and community in their work environments.

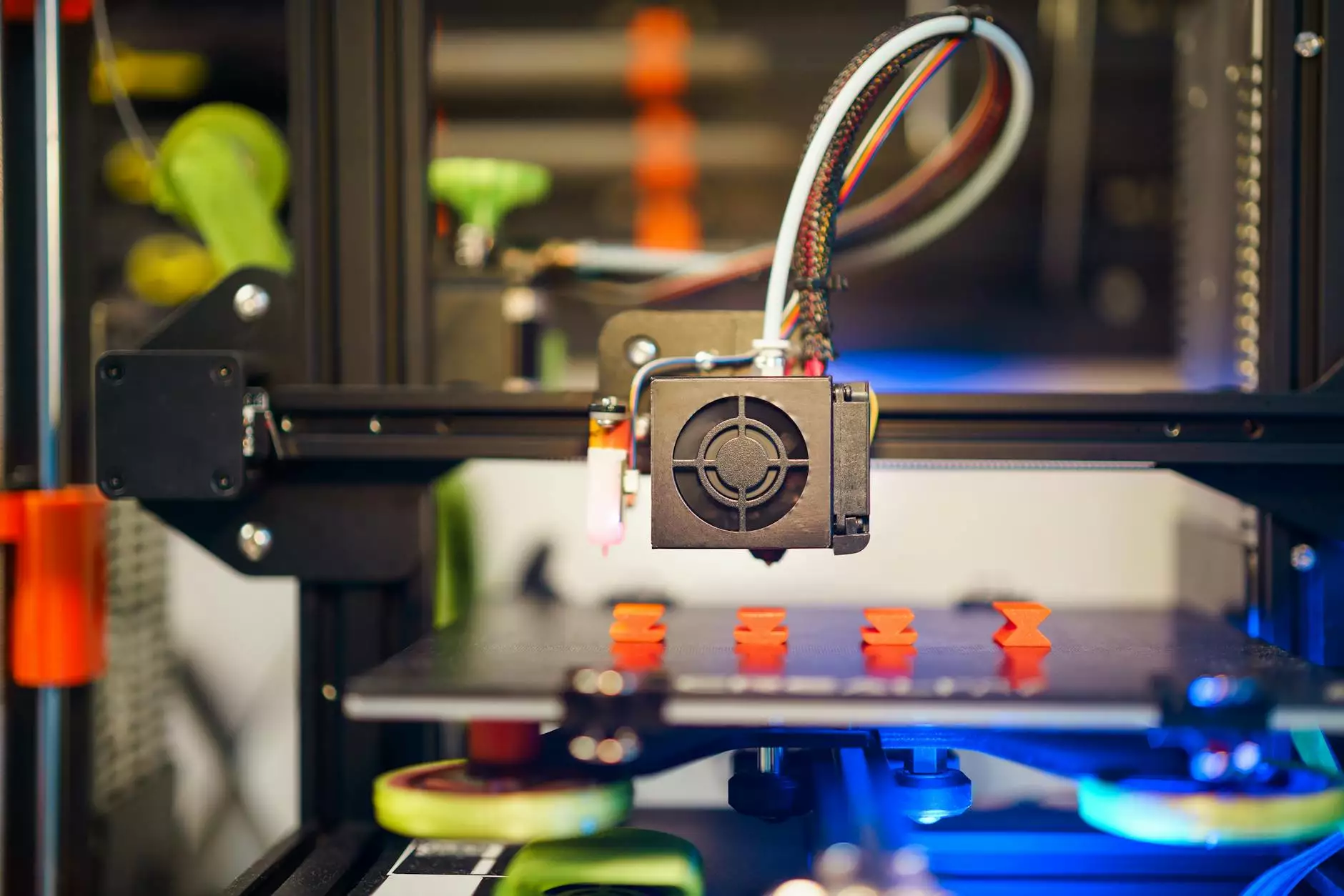

3. Integration of Technology in Real Estate

Technology continues to revolutionize the commercial real estate sector. From artificial intelligence (AI) and machine learning to virtual reality (VR) and augmented reality (AR), tech advancements are altering how properties are marketed and managed. Here are some key technological trends in the industry:

- Smart Buildings: The integration of IoT devices in commercial properties enhances energy efficiency and bolsters security.

- Data Analytics: Investors utilize data analytics to make informed decisions, leveraging insights on market trends and tenant preferences.

- Virtual Tours: VR technology allows potential tenants to explore properties remotely, streamlining the leasing process.

4. Sustainability and Green Building Practices

As global awareness of climate change increases, the demand for sustainable buildings and practices in real estate is paramount. Developers are prioritizing green building initiatives, which include energy-efficient systems, sustainable materials, and environmentally friendly designs. Properties that meet LEED certification and other green standards tend to attract more tenants and achieve higher valuations. This ongoing shift towards sustainability not only benefits the environment but also enhances the overall appeal and marketability of commercial spaces.

The Impact of Economic Trends on Commercial Real Estate

The commercial real estate market is notably sensitive to economic fluctuations. Economic recovery rates, interest rates, and construction costs profoundly influence real estate dynamics. Investors must remain vigilant to these changes, as they directly correlate with property values and market demand.

1. Interest Rates and Financing

Recent shifts in interest rates have significant implications for commercial real estate financing. As rates increase, borrowing costs rise, potentially dampening investment enthusiasm. Savvy investors are adapting by seeking alternative financing methods, such as joint ventures or crowdfunding, to mitigate risks associated with higher borrowing costs.

2. Job Market Dynamics

The strength of the job market directly influences demand for commercial real estate. With more job opportunities, there is a concurrent demand for office spaces and retail properties. Monitoring job growth trends can provide valuable foresight into the stability of the commercial real estate market.

Geographical Trends in Commercial Real Estate

Commercial real estate trends can also vary significantly by region. Urban areas continue to draw significant investment due to their dense populations and economic activity, while suburban areas are becoming increasingly attractive due to their affordability and growing amenities.

1. Urban vs. Suburban Development

While urban centers have traditionally been the hub of commercial activity, there is a noticeable migration toward suburban markets. This trend is driven by several factors, including:

- Housing Affordability: With property prices soaring in cities, many businesses are considering suburban locations to reduce costs.

- Remote Work Flexibility: As companies adopt remote work policies, the need for prime urban office space diminishes.

- Quality of Life: Suburbs often offer a better quality of life, attracting talent seeking a balanced lifestyle.

2. International Investment Trends

International investors are becoming increasingly interested in commercial real estate as a means to diversify their portfolios. Regions known for their stable political environments and strong economic fundamentals, such as Singapore, continue to attract foreign investment. This influx of capital can positively impact local markets, driving prices up and stimulating development.

Conclusion: Navigating the Future of Commercial Real Estate

As we look ahead, navigating the landscape of the commercial real estate industry trends requires a proactive approach. Investors and developers who capitalize on emerging trends, embrace technological advancements, and prioritize sustainability will position themselves for success. The interplay between market demands and economic indicators will dictate the future trajectory of commercial real estate, making it imperative for stakeholders to remain informed and adaptable.

In summary, the commercial real estate landscape is rich with opportunities for those willing to innovate and adapt. By staying ahead of trends and understanding market dynamics, real estate professionals can ensure their strategies align with the evolving needs of tenants and investors alike. The future of commercial real estate is bright for those prepared to embrace change and transformation.